Introduction

Did you know that catching the influenza can cost you more than just a week of misery? The price tag isn’t just about co-pays and prescriptions—it’s a hidden financial disaster waiting to happen.

We’re diving deep into the unexpected expenses of influenza in 2025, revealing the costs that absolutely blindside the average person, and how you can prepare now to save thousands.

The Invisible Threat: Understanding Influenza Beyond a Simple Cold

Everyone thinks they know the flu. It’s a miserable week, a few days off work, and then you’re back to normal, right? That dangerous assumption is precisely what leads to the secret, exploding costs we’re about to explore.

Influenza is not a super-cold. It is a highly contagious, acute respiratory illness caused by influenza viruses. These viruses are masters of mutation, which is why we need a new vaccine every year.

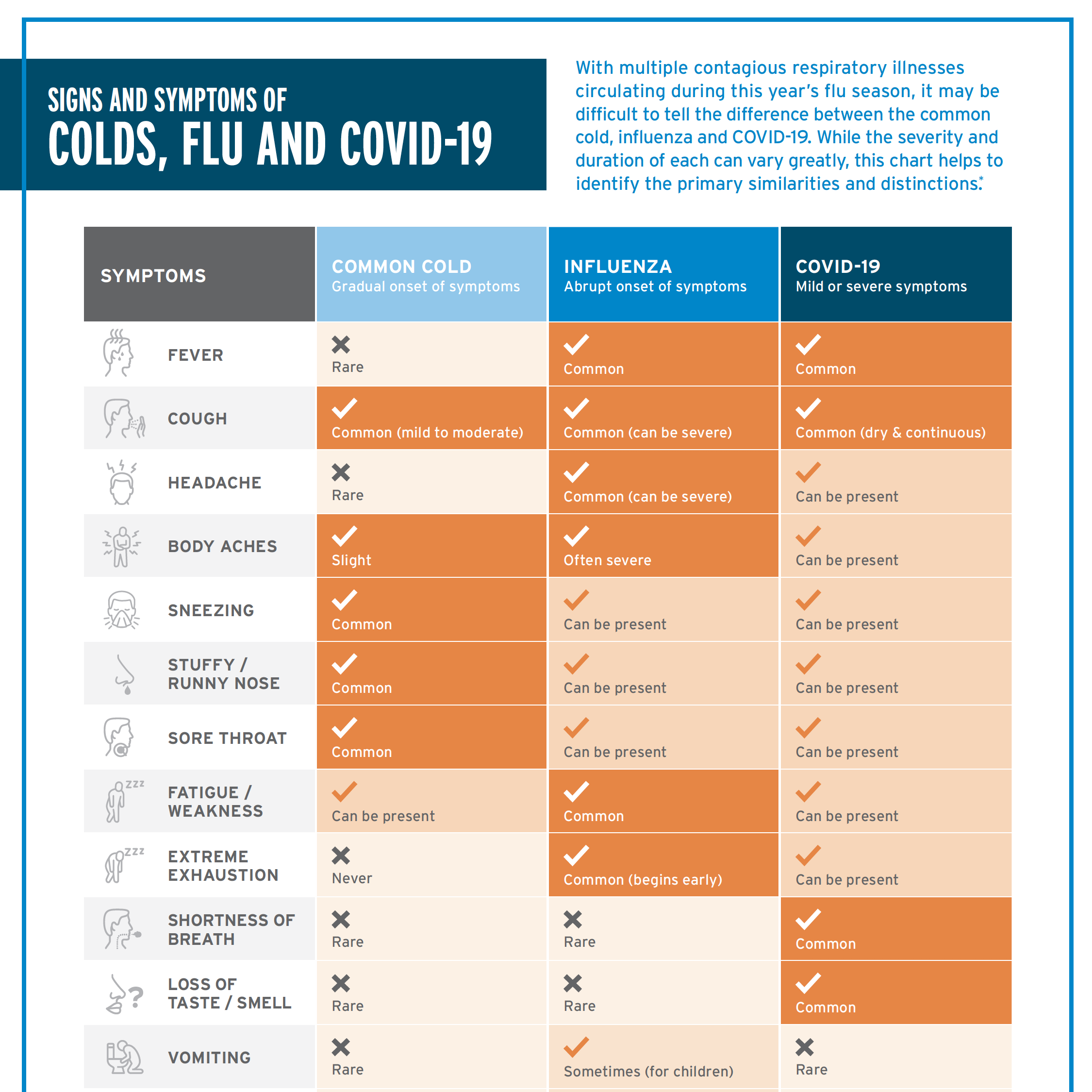

The Flu vs. A Cold: Why the Symptoms for Influenza Signal Bigger Trouble

The financial devastation starts with misdiagnosis. Many people try to “power through” what they think is just a bad cold. However, the true symptoms for influenza are far more debilitating and are the first warning sign that you might be heading toward an expensive medical intervention.

| Symptom | Common Cold | Influenza (The Flu) | Financial Warning Level |

| Fever | Rare | Common, sudden onset (100°F–102°F+) | HIGH (Signals need for testing/medication) |

| Aches/Pains | Mild, localized | Severe, all over the body | VERY HIGH (Often requires prescription pain relief) |

| Fatigue | Mild | Extreme, can last weeks | EXTREME (Directly impacts lost wages) |

| Onset | Gradual | Abrupt (sudden and intense) | HIGH (Leads to immediate sick leave) |

| Complications | Rare | Common (Pneumonia, Bronchitis) | CATASTROPHIC (Triggers hospitalization) |

When the Symptoms for Influenza Turn Deadly (And Expensive)

The real financial danger comes from complications. For vulnerable populations—the very young, the elderly, and those with chronic conditions—the flu is a fast track to the Emergency Room.

-

Pneumonia: The most common serious complication. It requires aggressive treatment, often involving hospitalization, IV antibiotics, and respiratory support.

-

Myocarditis: Inflammation of the heart.

-

Encephalitis: Inflammation of the brain.

-

Secondary Bacterial Infections: The flu weakens your system, making you an easy target for other severe infections.

These complications don’t just add zeroes to your bill; they transition the illness from a manageable expense to a genuine financial crisis. You’re not paying for a doctor’s visit anymore; you’re paying for days in an Intensive Care Unit (ICU).

The Hidden Cost Breakdown: Where Your Money Really Goes

The average person only budgets for the obvious: the doctor’s visit and the medication. But the secret, exploding cost of influenza is found in four categories no one talks about until they’re drowning in debt.

1. The Direct Medical Costs: The Bills You Can’t Outrun

These are the obvious, upfront costs—the things your insurance might cover, but often leave you with a surprisingly large bill.

-

Initial Doctor’s Visit: $150–$350 (or your specialist co-pay).

-

Rapid Flu Test: $50–$150.

-

Antiviral Medications (e.g., Tamiflu): $100–$250 (if not fully covered by insurance).

-

Over-the-Counter (OTC) Relief: $50–$100 (fluids, fever reducers, cough suppressants).

Expert Insight: Many insurers mandate a high deductible plan. This means you might pay 100% of the first few thousand dollars of treatment costs before your coverage truly kicks in. That initial visit can quickly turn into a $1,000+ personal expense.

The Hospitalization Domino Effect

If you’re admitted to the hospital for pneumonia or another severe complication, the cost skyrockets. According to a recent study on healthcare spending, the cost of an average inpatient stay in the United States continues to rise significantly each year. (For authoritative data on rising healthcare costs, you can consult an organization like the Kaiser Family Foundation).

-

Standard Inpatient Stay (3-5 days): $15,000–$30,000

-

ICU Stay (with ventilator): $50,000–$100,000+

This is the financial devastation few people anticipate when they first feel the symptoms for influenza.

2. The Indirect Financial Costs: The Wages and Opportunities Lost

This is the secret killer. It’s the cost of being absent from your life and your job. For many, this is where the true financial pain of influenza is felt.

A Deep Dive into Lost Income

If you are a salaried employee with sufficient sick leave, you might be buffered. But for the massive segment of the population that works hourly, freelance, or in the gig economy, a week of the flu means zero income.

Let’s assume an average wage of $25/hour:

| Scenario | Lost Income (1 week) | Lost Income (2 weeks) |

| Hourly Worker (40 hrs/wk) | $1,000 | $2,000 |

| Freelancer (80 hrs project) | $2,500+ (Based on $30/hr rate) | $5,000+ |

| Parents of Sick Child (Time Off) | $500–$1,000 (Based on taking partial sick time) | $1,000–$2,000 |

This doesn’t even account for the opportunity cost—the project you couldn’t bid on, the promotion you missed, or the client you lost because you couldn’t meet a deadline.

3. The Recovery and Rehabilitation Costs

The flu doesn’t just end when the fever breaks. Recovery from a severe case of influenza—especially one involving complications—can take weeks or months. This means extended costs that often go overlooked:

-

Home Care/Cleaning Services: If you are too weak to manage your home.

-

Therapy/Rehabilitation: If the illness was severe enough to cause prolonged muscle weakness or respiratory issues.

-

Nutritional Supplements: Extra cost for high-quality food, vitamins, and specialized supplements to rebuild your immunity.

-

Childcare Costs: If a sick parent is unable to care for their children during their recovery.

4. The Long-Term Health and Productivity Tax

Even after recovery, the flu can leave a lasting impact. Many people report weeks of residual fatigue, often referred to as “Post-Flu Syndrome.” This translates to a tax on your productivity and quality of life.

-

Lower concentration at work.

-

Delayed professional projects.

-

Increased risk of subsequent minor illnesses due to a weakened immune system.

The cost is not a dollar amount—it’s the erosion of your competitive edge and your overall life satisfaction.

Defending Your Wallet: Proactive Strategies to Combat Influenza Costs

The single biggest takeaway from this deep dive is this: The most expensive treatment for influenza is the one you could have prevented. Your strategy must be focused on defense and preparation.

1. The Single Best Financial Investment: The Annual Flu Vaccine

This is a non-negotiable step. The flu shot is your absolute best defense. Many pharmacies and employers offer it for free, making the financial barrier non-existent for most people. Even if you have to pay a small co-pay, it is pennies compared to the $1,000+ cost of an uncomplicated case of the flu.

The single best financial investment you can make is the annual flu vaccine. The effectiveness of the vaccine is key. While it doesn’t guarantee you won’t get the flu, studies consistently show it significantly reduces the severity of the illness. Reducing severity means you are much less likely to require hospitalization, which is the ultimate cost-saver. For the most up-to-date and authoritative data on the current season’s vaccine effectiveness and recommendations, you should consult the Centers for Disease Control and Prevention (CDC). Furthermore, to better understand how these costs fit into the broader American healthcare landscape and the rising cost of treatment, explore the detailed research compiled by the Kaiser Family Foundation on U.S. health spending.

2. Immune System Super-Chargers: Making Your Body a Fortress

A robust immune system can downgrade a severe case of influenza into a moderate one, saving you thousands in medical bills.

-

Prioritize Sleep: Aim for 7–9 hours a night. Chronic sleep deprivation is a proven killer of immune response.

-

Nutrient Density: Focus on foods rich in Vitamin C, Vitamin D, and Zinc.

-

Stress Management: High cortisol levels from stress severely suppress your immune system. Use exercise, meditation, or short breaks to manage your mental load.

3. Financial Preparation: The Emergency Fund for Illness

No matter how prepared you are, a severe illness is always a possibility. A financial safety net is the only way to shield yourself from the debt of an ER visit or hospitalization.

-

The Sickness Savings Bucket: Aim to save an equivalent of one month’s worth of living expenses specifically for emergency health costs and lost wages.

-

Review Your Insurance Annually: Understand your deductible, your out-of-pocket maximum, and what your plan covers regarding urgent care vs. the Emergency Room. Urgent care is almost always cheaper than the ER for non-life-threatening symptoms for influenza.

Beyond the Bill: The Psychological and Social Costs of Influenza

The final, often-ignored layer of the secret cost is the human toll.

The Social Stigma and Professional Backlash

In today’s fast-paced work environment, taking time off—even for a severe illness like influenza—can carry a professional cost.

-

Increased workload for colleagues.

-

Perceived lack of commitment.

-

Delays in key projects that impact your performance review.

The Emotional and Family Strain

Dealing with severe symptoms for influenza is emotionally draining. It puts a strain on family members who must take on caregiving roles, manage the household, and often take time off their own jobs to help.

-

Caregiver Burnout: A spouse or partner may become exhausted trying to manage work, a sick loved one, and children.

-

Loss of Quality Time: Weeks are lost where you are simply too ill to engage with your family, eroding precious time and emotional connection.

2025 Innovations: New Tools in the Fight Against Influenza

As we move deeper into the 21st century, research is constantly delivering better tools to combat the financial and physical toll of influenza.

Better Diagnostics and Telehealth

The rise of rapid, at-home diagnostic kits and expanded telehealth services is a major cost-saver.

-

Skip the Co-Pay: A simple telehealth visit for initial assessment of symptoms for influenza is often significantly cheaper than an in-person doctor’s appointment.

-

Rapid Rx: If your doctor determines an antiviral is necessary, they can send the prescription immediately, ensuring you start treatment within the crucial 48-hour window, which dramatically improves outcomes and lowers the risk of high-cost complications.

Universal Flu Vaccines (The Future Cost-Saver)

Researchers are hard at work developing a “universal” influenza vaccine—a single shot that would be effective against all strains and would not need to be updated annually. While not widely available in 2025, this future innovation promises the biggest financial reduction of all, as it would drastically reduce annual illness rates and their associated costs worldwide.

Frequently Asked Questions (FAQ)

What are the main symptoms for influenza I should watch out for?

The major symptoms for influenza are a sudden onset of high fever (100°F+), severe body aches, extreme fatigue, and a dry cough. Unlike a cold, which is gradual and usually includes a runny or stuffy nose, the flu hits you like a truck and is debilitating. If you experience these severe symptoms, contact a healthcare provider immediately to determine if an antiviral is appropriate.

Is the cost of the influenza vaccine worth it every year?

Absolutely. The cost of the influenza vaccine is negligible, often free, compared to the thousands of dollars you could spend on doctor’s visits, medications, lost wages, and potential hospitalization from an actual case of the flu. It is the single best preventative financial tool available.

Can I treat influenza with only over-the-counter medications?

While OTC medications like acetaminophen (Tylenol) and ibuprofen (Advil) can manage the fever and aches of influenza, they do not treat the viral infection itself. For high-risk individuals or severe cases, an antiviral medication (like Tamiflu) prescribed within the first 48 hours is crucial to shortening the illness and preventing life-threatening complications that lead to massive bills.

How much can I expect to lose in wages from a typical case of the flu?

For an individual without paid sick leave, a typical, uncomplicated case of influenza requires 5–7 days off work. Based on a moderate $25/hour wage, you can expect to lose between $1,000 and $1,400 in just one week. If complications arise and hospitalization is required, lost wages can easily exceed $5,000.

Conclusion: Don’t Be a Financial Statistic

The secret cost of influenza in 2025 isn’t just a medical bill; it’s a hidden tax on your income, your productivity, and your family’s emotional reserves. The reality is stark: an ounce of prevention is not just worth a pound of cure, it’s worth tens of thousands of dollars in averted medical debt and lost opportunity.

You now have the insights: you know the true cost, you recognize the crippling symptoms for influenza, and you have the three-pronged strategy for defense (Vaccination, Immunity, and Financial Savings).

Take control of your health and your wallet today. Don’t wait until the fever hits to realize the financial disaster you could have avoided.

Read More about Finally The Secret Telehealth Mistakes 99% of New Users Make (And How to Avoid Them)